Communication Services Drops to #5

The composition of the top five sectors remains largely stable this week, with only slight adjustments in positioning. Consumer staples continue to lead the pack, followed by utilities, financials, real estate (moving up one spot), and communication services (dropping to fifth). This defensive lineup persists despite a rallying market, presenting an interesting dilemma for sector rotation strategies.

(1) Consumer Staples – (XLP)

(2) Utilities – (XLU)

(3) Financials – (XLF)

(5) Real-Estate – (XLRE)*

(4) Communication Services – (XLC)*

(6) Healthcare – (XLV)

(7) Industrials – (XLI)

(8) Materials – (XLB)

(11) Technology – (XLK)*

(10) Energy – (XLE)

(9) Consumer Discretionary – (XLY)*

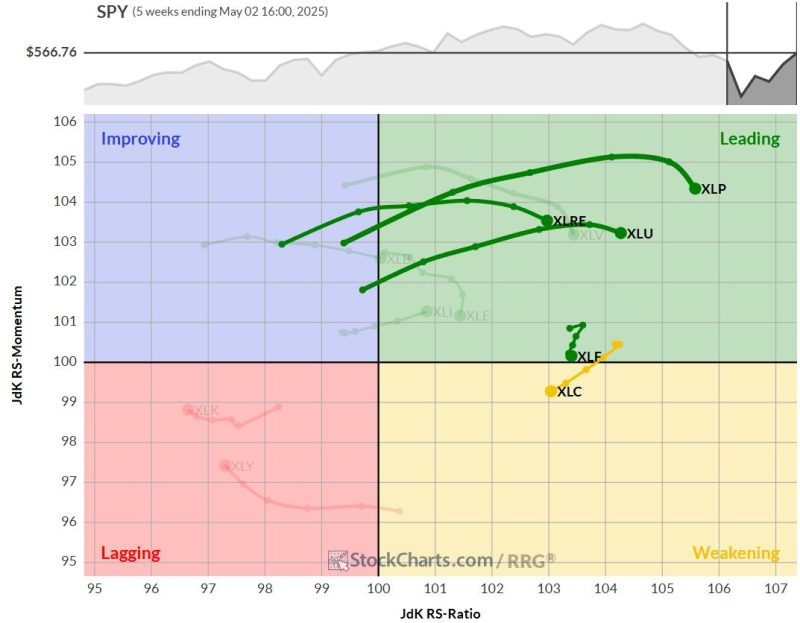

Weekly RRG

The weekly Relative Rotation Graph (RRG) paints a picture of potential change on the horizon.

While staples, utilities, real estate, and financials maintain their positions in the leading quadrant, they show signs of losing relative momentum over the past few weeks.

Financials, particularly, are teetering on the edge of rolling into the weakening quadrant.

Communication services have already shifted, now firmly in the weakening quadrant and traveling on a negative RRG heading. This movement explains its drop to the fifth position in our sector rankings.

Daily RRG

Switching to the daily RRG, we see a slightly different picture for our top sectors.

Staples, utilities, real estate, and financials are all positioned in the weakening quadrant, traveling on negative RRG headings.

This short-term view indicates that we must closely monitor these sectors to determine if they can regain momentum before potentially dropping out of the top five.

Interestingly, communication services is showing signs of life on the daily chart. Despite falling to the fifth position overall, its tail is now in the improving quadrant and moving toward leading.

The caveat? It’s a very short tail, close to the benchmark—essentially moving in line with the market. This makes communication services the sector most at risk of losing its top-five status in the near term.

Consumer Staples

Consumer staples is bumping up against overhead resistance between $82.50 and $83.

This hesitation in upward price movement is causing weakness in the RS line, which has started to dip.

Consequently, the RS momentum line is rolling over. However, the high RS ratio—indicating a strong relative trend—is keeping staples at the top of our list for now.

Utilities

Utilities has been flirting with a breakout since the start of 2025, pushing against overhead resistance around $80 about four times already.

When it breaks, we’ll likely see an acceleration towards the all-time high just above $82.50.

Like staples, the inability to break resistance is causing a stall in the RS line and a rollover in relative momentum.

Financials

After a strong rally off the $42 support level, previously resistance (the old technical adage holds true), financials is now facing a challenge.

The rally is approaching the former rising support level that marked the uptrend channel. This could cause some hesitation in both price and relative strength.

The RS line remains within its rising channel, but momentum has waned, causing the green RS momentum line to roll over.

Real-Estate

Real estate moved up one position to fourth and is still emerging from a long relative downtrend that began in April 2022.

The RS ratio line has picked up the relative strength rally that started in early 2025 but is now stalling.

This has resulted in the green RS momentum line rolling over. On the price chart, real estate is mid-range with room to move higher.

Communication Services

Communication services have dropped to the fifth position, but the price chart has an interesting development.

Last week, the price broke back above the old neckline of a small head-and-shoulders pattern. The fact that we’re now rallying above this neckline could indicate a failed head-and-shoulders pattern—usually a very strong bullish sign.

However, recent weakness in relative strength has pushed the sector deeper into the weakening quadrant on the RRG.

This sector must pick up rapidly in the coming weeks to maintain its position in the top five.

Portfolio Performance

The defensive positioning of our top five sectors is leading to underperformance as the broader market rallies.

Currently, we remain at approximately a 3% underperformance compared to SPY just like last week.

However, from the perspective of sector rotation, we must still consider this rally in the S&P 500 to be temporary.

The underlying message continues to emphasize defense.

It’s important to remember that there is always a lagging element in RRGs and this strategy.

If the market has truly turned, we will see that shift reflected in our sectors, and at some point, we will start to make up the difference.

These performance gaps can change very rapidly in favor of the RRG portfolio when the market comes under pressure and our defensive sectors start to lead again.

#StayAlert and have a great week — Julius